Hamilton Real Estate Report For October 2017 Stats

Hamilton Real Estate October 2017 Market Report

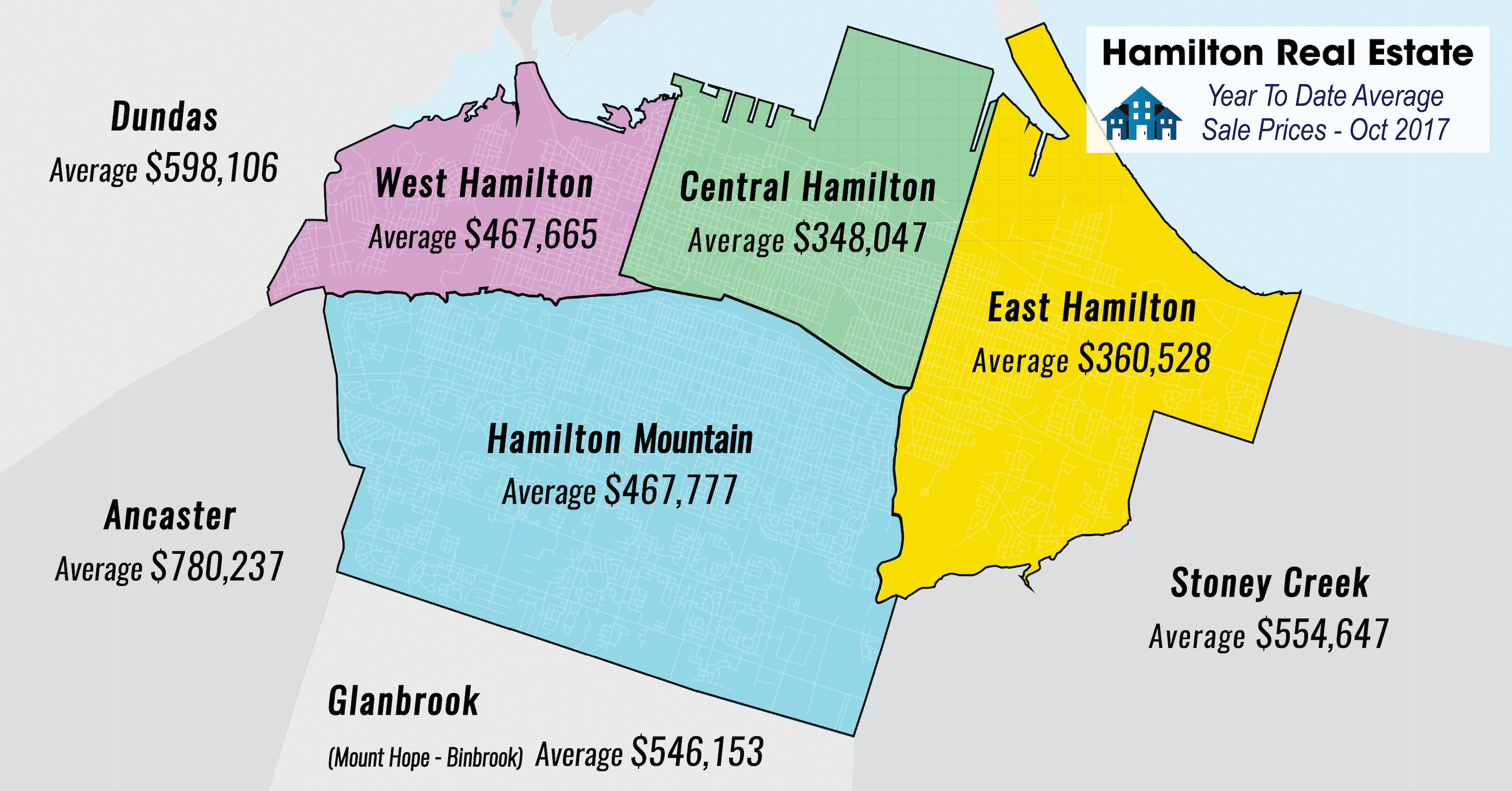

October 2017 had 1999 New Listings, ALL Types, reported which is up 12.2% from October 2016, and 14.3% higher than the 10-year average. All Residential Sales of 1272 Properties were down only 4.9% from the same month last year. Freehold Sales were down by 12% and Condominium Sales were UP 23.6%. These numbers are showing the INCREASE in Condominium interest. The Average Residential Freehold Sales Price of properties sold through the RAHB Multiple Listing Service® (MLS) system in October 2017 was $602,984 compared to $541,076 the same month last year, an increase of 11.4%, and the Condominium Average Price is $388,601 compared to $374,021, which is up 3.9% from last year for this month.

Trending now...Sales Up Slightly in and around Hamilton Ontario!

The data provided by the Hamilton-Burlington Real Estate Board shows a bit of an increase in Sales. It seems that most of this increase can be attributed to the Condominium Market. The other interesting point is that the Sales to new Listings ratio is also crept up this month to 69%. Still not the 80% and over it was in the Spring of 2017, however, it has entered the lower end of a Sellers Market. The end of month listing inventory shows 2445 Freehold Residential Properties left for sale, up 49.6% compared to 1634 left at the end of the month in 2016. Average days on the market increased from 22 to 31 for Freehold this month, and from 24 to 27 for Condominiums.

What is the Stress Test and is it having an effect on the Fall 2017 Market?

It is still a little early to tell how the Market will be affected by the Government imposed mandatory Stress Test, to take effect January 1st, 2018. A year ago, the federal government made a rule change that all borrowers who were putting less than 20% down on a purchase had to qualify under the Stress Test. The rule change just announced in October 2017 was that now ALL Borrowers, including those with more than 20% down,as well as existing borrowers looking to refinance, will need to qualify under this Stress Test. What is the Stress Test? When you are looking to qualify for a mortgage, you are essentially qualifying for your mortgage payment. Is your income enough for you to be able to make your monthly payment. Your monthly payment is determined by your interest rate, your amortization, and your mortgage amount. Previous to the stress test, we could use the actual mortgage rate (let’s say 3.29%) that you were getting to determine the mortgage payment for application purposes. Now, with the ‘Stress Test’, we would need to use a mortgage payment that is the greater of the Bank of Canada’s posted rate (currently 4.89%) or the actual rate you would be getting + 2%. So if you were getting a rate of 3.29%, you would need to qualify to carry your mortgage as if the rate was 5.29%. To clarify further, you have to qualify for the mortgage payment as if your rate was 5.29%, even though you would be receiving a rate of 3.29%. Basically, the New Government Regulations will reduce your ability to access the equity in your home and will limit those looking to purchase.

It is still a little early to tell how the Market will be affected by the Government imposed mandatory Stress Test, to take effect January 1st, 2018. A year ago, the federal government made a rule change that all borrowers who were putting less than 20% down on a purchase had to qualify under the Stress Test. The rule change just announced in October 2017 was that now ALL Borrowers, including those with more than 20% down,as well as existing borrowers looking to refinance, will need to qualify under this Stress Test. What is the Stress Test? When you are looking to qualify for a mortgage, you are essentially qualifying for your mortgage payment. Is your income enough for you to be able to make your monthly payment. Your monthly payment is determined by your interest rate, your amortization, and your mortgage amount. Previous to the stress test, we could use the actual mortgage rate (let’s say 3.29%) that you were getting to determine the mortgage payment for application purposes. Now, with the ‘Stress Test’, we would need to use a mortgage payment that is the greater of the Bank of Canada’s posted rate (currently 4.89%) or the actual rate you would be getting + 2%. So if you were getting a rate of 3.29%, you would need to qualify to carry your mortgage as if the rate was 5.29%. To clarify further, you have to qualify for the mortgage payment as if your rate was 5.29%, even though you would be receiving a rate of 3.29%. Basically, the New Government Regulations will reduce your ability to access the equity in your home and will limit those looking to purchase.Examples of Mortgage Qualifications After January 1st 2018

Approval for $500,000 today = $400,000 after Jan 1, 2018

Approval for $600,000 today = $480,000 after Jan 1, 2018

Approval for $700,000 today = $560,000 after Jan 1, 2018

Want to sign up now so you don’t miss out on any more listings? Go to:

Want to know what houses are selling for around you? Thinking of selling in the future and want to know what changes to do to get you Top Dollar? Is it time to get a Pinpoint Price Analysis on Your House? Get help now. Go to: