Home-Related Tax Deductions

Owning a home is a significant milestone — and one bonus is that it can come with significant tax savings! However, making the most of offerings like the Principal Residence Exemption can be tricky, and you may not be aware of all available tax-saving strategies. This guide rounds up the information you need about common Canadian home-related tax savings options and requirements for eligibility.

Buying a Home: Tax Benefits and Programs

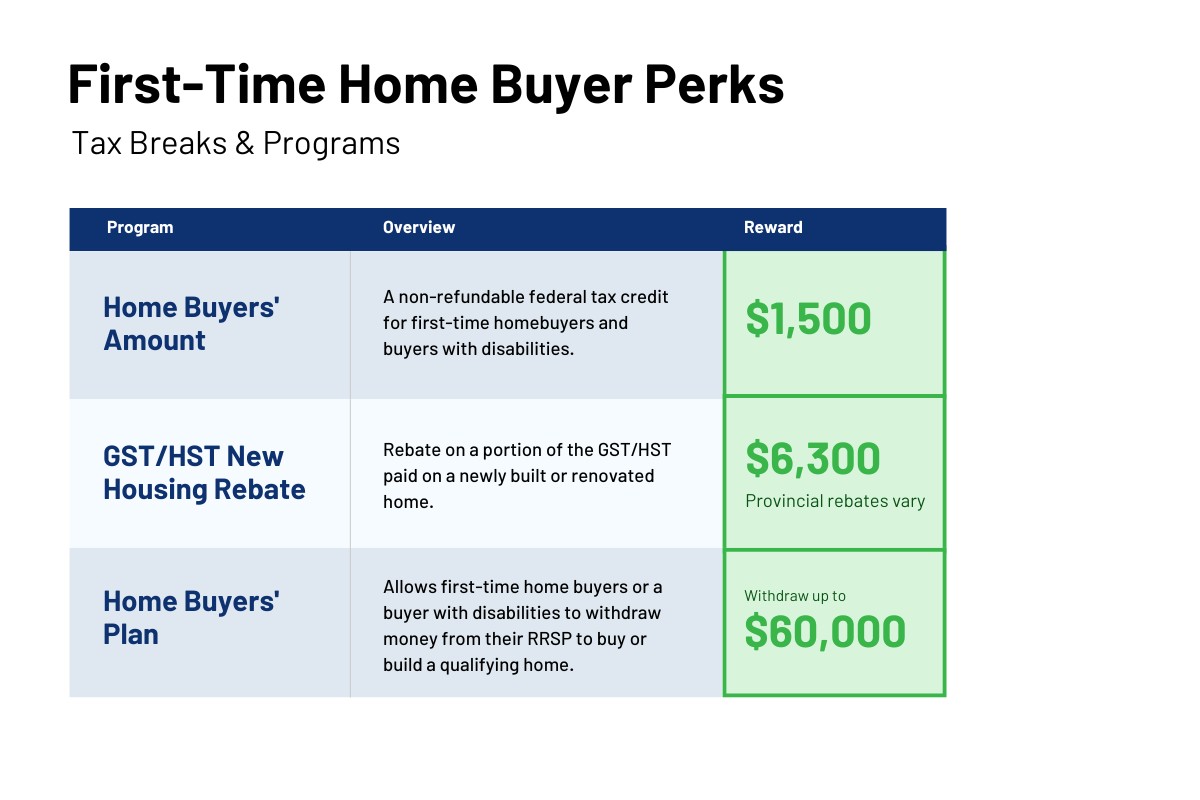

The Canadian government offers several programs to make a home purchase more affordable. These include:

Home Buyers’ Amount (HBA)

The HBA is a non-refundable tax credit for first-time home buyers and individuals with disabilities purchasing a home. You can claim up to $10,000 in expenses to get a federal tax credit of up to $1,500 (15% of $10,000).1 This credit can help offset some costs associated with buying a home, such as legal fees and land transfer taxes. To be eligible, you must be considered a first-time home buyer (generally, someone who hasn’t owned a home in the past four years) or meet specific criteria related to disabilities.2 The home must be your primary residence. If you purchase a home with a spouse or partner, only one of you may claim the credit.

GST/HST New Housing Rebate

If you purchase a newly built home or substantially renovate your existing home, you might be eligible for a GST/HST new housing rebate.3 The maximum federal rebate is $6,300, and the amount you qualify for varies depending on the home’s purchase price or fair market value (for substantial renovations) and other factors.4 Eligibility criteria and rebate amounts vary by province/territory, and some provinces offer substantial additional rebates. For example, Ontario offers rebates of up to $24,000, and does not require the home’s value to be under $425,000 (as is the case for federal rebates).

Home Buyers’ Plan (HBP)

The HBP isn’t a tax deduction or credit, but it allows you to withdraw up to $60,000 (increased significantly in recent years) from your Registered Retirement Savings Plans (RRSPs) to buy or build a qualifying home without immediate tax penalties.5 If you are buying a home as a couple, you can each withdraw up to $60,000 for a total of $120,000. However, you must repay the withdrawn amount to your RRSP over a 15-year period.

Note that this program is only available to first-time homebuyers or homebuyers with disabilities, and you must already have a written agreement to buy or build a qualifying home at the time of withdrawal.

Homeownership and Taxes

Once you own your home, you may be eligible for specific deductions and credits based on your personal situation. These include:

Home Accessibility Expenses

If you make renovations to your home to improve accessibility for a resident family member who is eligible for the Disability Tax Credit or is over the age of 65, you may be able to claim the Home Accessibility Tax Credit.6 This is a non-refundable tax credit on eligible expenses up to $20,000. The maximum credit you can claim is 15% of eligible expenses, up to a maximum of $20,000. Qualifying expenses can include wheelchair ramps, stair lifts, grab bars, and other modifications that improve mobility or reduce the risk of injury.

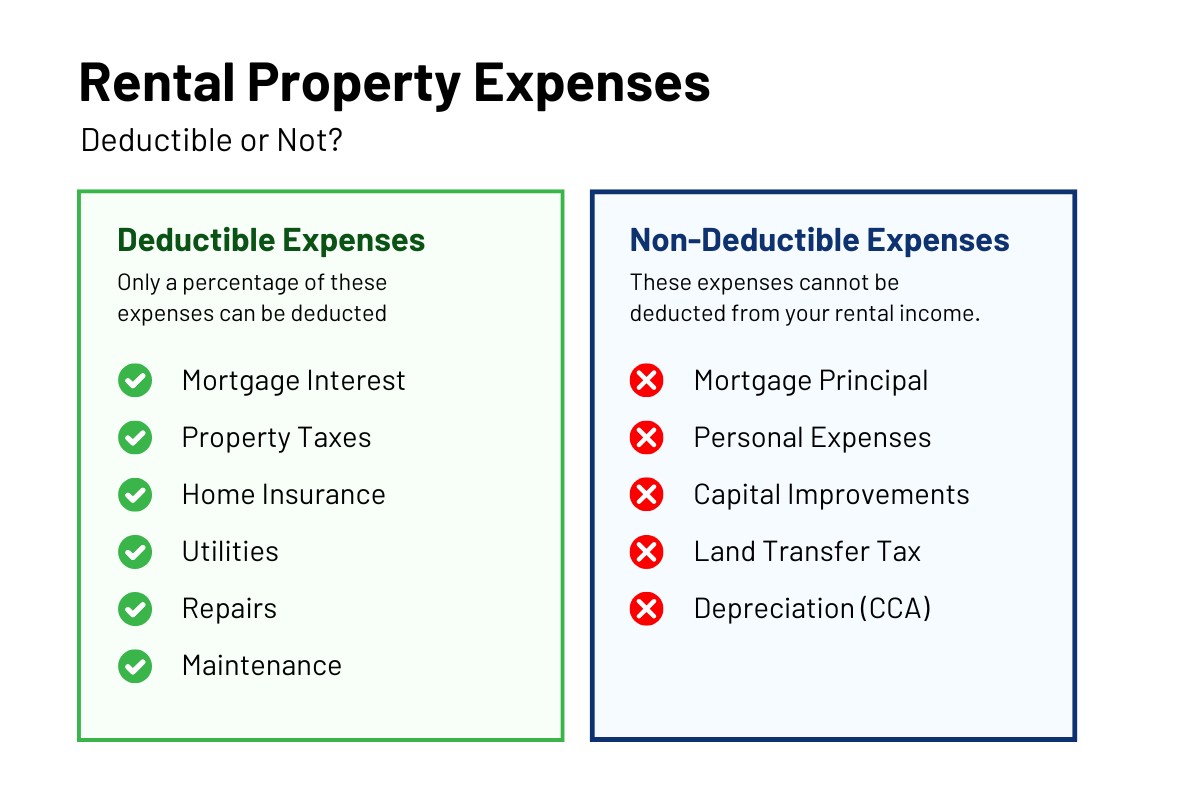

Rental-Related Expenses

If you rent out a portion of your home, you must report the rental income on your tax return.7 However, you can also deduct eligible expenses related to the rental property. While you can’t generally deduct mortgage interest payments from your taxes in Canada for your primary residence, if you rent out part of your home, you can deduct a proportional part of your mortgage interest related to the rental portion.8 You can also deduct a proportionate amount of other eligible expenses, such as repairs, utilities, property taxes, and home insurance, again, only related to the rental portion. It’s critical to keep accurate records of rental income and expenses.

Deductible expenses can include:

- Mortgage Interest: Proportionate mortgage interest for the rented area

- Property Taxes: Proportionate property taxes for the rented area

- Home Insurance: Proportionate home insurance premiums for the rented area

- Utilities: Proportionate costs for electricity, heating fuel, and water used by the tenant

- Repairs: Cost of repairs to the rented area (e.g., fixing a leaky faucet, repairing a broken window)

- Maintenance: Regular maintenance costs for the rented area (e.g., cleaning, snow removal)

Non-deductible expenses can include:

- Mortgage Principal: Mortgage principal payments are not deductible

- Personal Expenses: Expenses not directly related to the rental activity (e.g., personal use of utilities)

- Capital Improvements: Expenses that improve or add value to the property (e.g., adding a new deck, renovating the kitchen)

- Land Transfer Tax: Land transfer tax paid when you purchased the property

- Depreciation (CCA):While you can claim Capital Cost Allowance (CCA) to deduct a portion of the cost of the building over time, it is not a direct deduction from rental income and and requires complex calculations

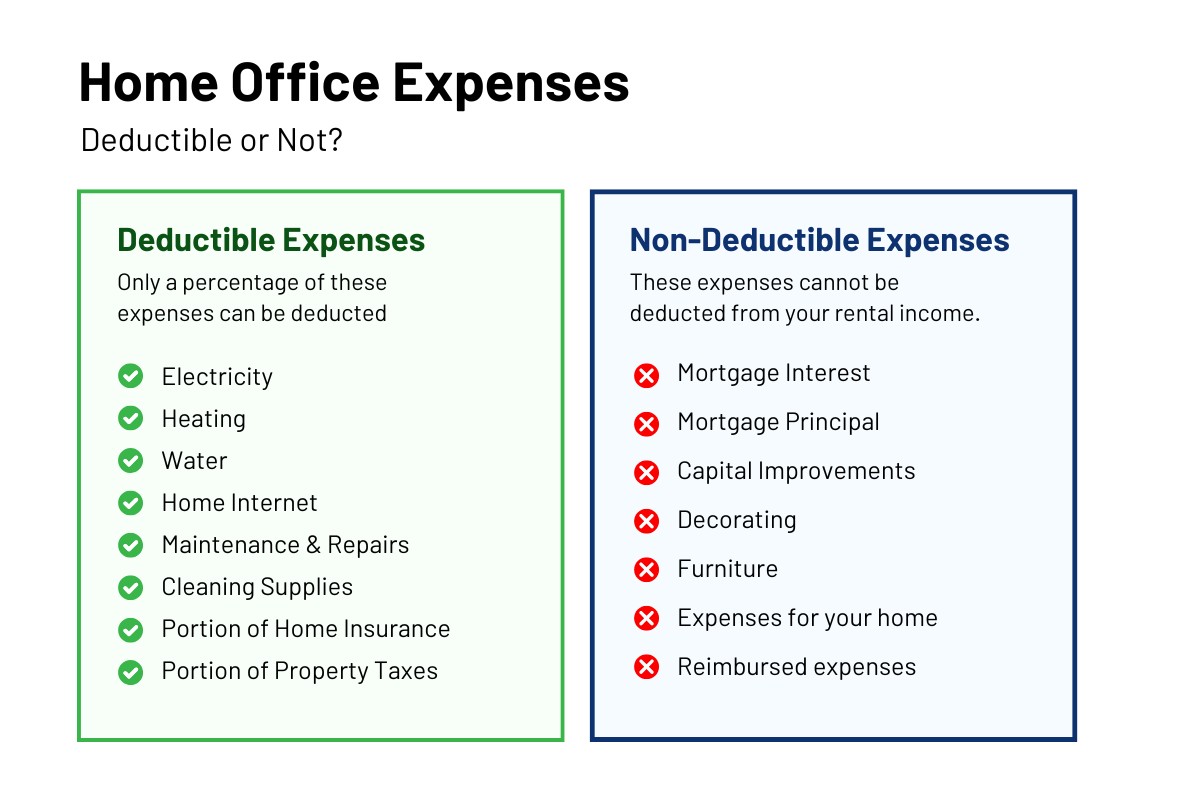

Home Office Expenses

If you work from home, you may deduct the proportion of eligible expenses that relate to your workspace, such as electricity, heating, maintenance, and repairs.9 Note that you can deduct repairs to your home office (and a portion of other eligible home expenses), but you cannot deduct improvements to your home office that increase the value of your property (those would be capital expenses and impact your cost base).

You must meet specific criteria for your workspace to be considered a home office, such as being required to work from home by your employer (which can include voluntarily entering into a formal telework arrangement with your employer), working more than 50% of the time from the work space for at least 4 consecutive weeks, among other requirements.10

Selling Your Home and the Principal Residence Exemption (PRE)

In Canada, capital gains from the sale of your principal residence are generally protected thanks to the principal residence exemption (PRE).11 If you buy a home for $300,000 and sell it for $500,000, the $200,000 gain is generally tax-free. However, the gains are only fully tax-free if the home was your primary residence for every year that you owned it. If you rented it out for some years, or if you have designated a different property as your principal residence for certain years, you will likely owe some capital gains tax on the portion of time it was not your principal residence. Designating a property as your principal residence can have complex implications, especially if you have owned multiple properties. It’s crucial to understand the rules and seek professional advice if needed.

Provincial/Territorial Tax Credits and Grants

Many provinces and territories offer their own tax credits and grants for homeowners. These can include incentives for energy-efficient renovations, property tax rebates, or assistance for first-time home buyers. Check your province or territory’s government website for specific programs.

Record-Keeping Tips for Homeowners

Organized records are essential. Keep documents like mortgage statements, property tax bills, and receipts for home improvements readily accessible. Keep both physical and digital copies (scan and save!). Keep all home-related records for as long as you own the home — and it’s always safest to keep digital copies indefinitely. This is especially important for capital improvements as these records are essential for calculating your adjusted cost base when you sell.

Conclusion

Understanding the tax aspects of homeownership is crucial. This guide provides a starting point, but consulting with a tax professional is strongly recommended for personalized advice to ensure you are maximizing your benefits and complying with all tax requirements.

Have questions about real estate or need a referral to a trusted tax advisor? Contact us today!

Note: This information is intended for general guidance only. Tax regulations are subject to change.

Source:

- TurboTax:

https://turbotax.intuit.ca/tips/who-can-benefit-from-the-home-buyers-tax-credit-5203?srsltid=AfmBOoreUf0PSqttaeI9rIDlWY2qr9S0RDvqg01VZLDKEfpl6YlME1Yk - Canada Revenue Agency –

https://www.canada.ca/en/revenue-agency/news/newsroom/tax-tips/tax-tips-2025/keys-unlocking-housing-related-tax-savings-filing-season.html - Canada Revenue Agency –

https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/gst-hst-businesses/gst-hst-rebates/new-housing-rebate.html - Canada Life –

https://www.canadalife.com/investing-saving/mortgages/buying-your-first-home/first-time-home-buyer-programs/what-is-the-gst-hst-new-housing-rebate.html - Canada Revenue Agency –

https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/rrsps-related-plans/what-home-buyers-plan/participate-home-buyers-plan.html - Canada Revenue Agency –

https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/about-your-tax-return/tax-return/completing-a-tax-return/deductions-credits-expenses/line-31285-home-accessibility-expenses.html - Canada Revenue Agency –

https://www.canada.ca/en/revenue-agency/services/forms-publications/publications/t4036/rental-income.html - TurboTax –

https://turbotax.intuit.ca/tips/tips-for-renting-out-your-house-6375 - Canada Revenue Agency –

https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/about-your-taxes/tax-credits-deductions-expenses/work-from-home-expenses.html - Canada Revenue Agency –

https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/about-your-tax-return/tax-return/completing-a-tax-return/deductions-credits-expenses/line-22900-other-employment-expenses/work-space-home-expenses/who-claim/detailed-method.html - Canada Revenue Agency –

https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/about-your-tax-return/tax-return/completing-a-tax-return/personal-income/line-12700-capital-gains/principal-residence-other-real-estate/sale-your-principal-residence.html