Jan to June 2020 Real Estate Sold Statistics Hamilton

January to June 2020 Year To Date Statistics & Analysis

We have now completed our third full month since COVID-19 was officially declared a Pandemic on March 11th, 2020. The Ontario Government deemed Real Estate an Essential Service on March 23rd, and although slow and very cautious at first, transactions continued to occur. Now that most of Ontario has entered into Phase 2 of re-opening businesses, and Real Estate transactions have continued to adapt to the new regulations imposed with social distancing, pre showing Covid Questionnaires, wire transfers and direct deposits more widely used, we are seeing average prices continuing to rise, properties selling in less time, and more and more multiple offer situations depending on the price range.

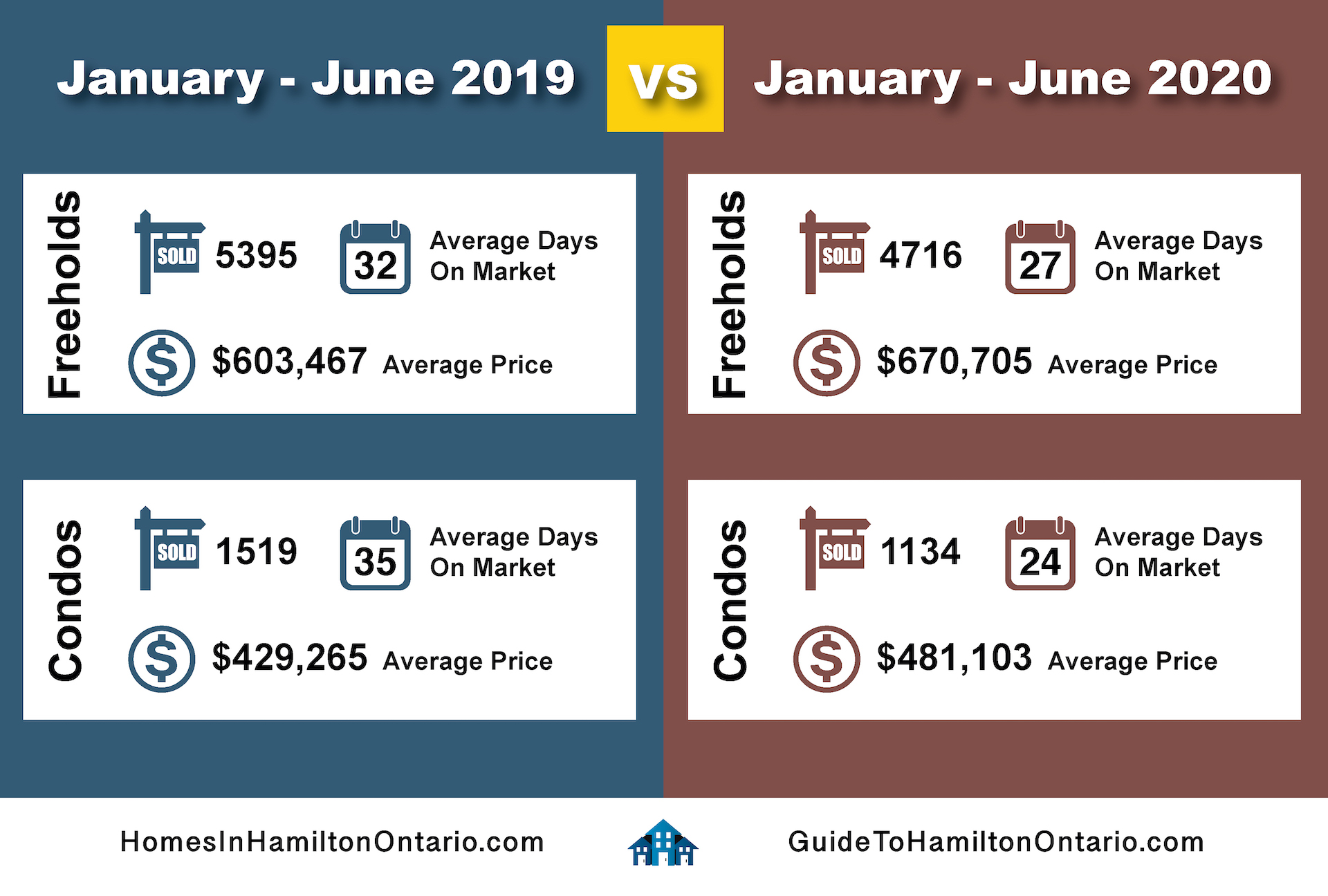

When looking at the January to June Year To Date numbers it is evident that 2020 is well on its way to catching up and even surpassing the same period in 2019. Residential and Condominium Units for sale are still lower year over year, with 6914 Listings in 2019 for the first 6 months compared to 5850 so far in 2020. Average price of Residential Freehold has gone up from $603,467 in 2019 to $670,705. Condominium Average Price has also gone up from $429,265 to $481,103. On average it took 32 days for a residential property to sell compared to only 27 days in 2020, and 35 days for a condominium and only 24 days this year. If you want to have a good look into how prices have changedBelow you will see charts and maps for every district and neighbourhood throughout the Hamilton area.

Covid-19 policies and safeguards are continuing, such as virtual showings (less now than at the beginning of the pandemic), 3D virtual tours and floor layouts, online evaluations, and still some home inspections are being performed without the Buyers present or at least with proper protocols to keep everyone safe. Digital signatures are now the norm for all and are very simple to use. Our main concern is still and always will be, the health and well being of you and your family. Please reach out if you have any questions or if you need any help!

Here is a look at the third full month of statistics since Covid-19. June 2020 had 1806 Total Residential Property Listings come through the Hamilton Real Estate Board, which is down from the 1936 Listings in June 2019, as reported by The REALTORS ® Association of Hamilton-Burlington (RAHB). Hamilton had 1160 of those (down from 1288 in 2019) and Burlington’s share was 459 ( UP from 430 in June 2019).

Residential Sales located throughout the RAHB market area (including Burlington and all the outlying areas covered by The REALTORS ® Association of Hamilton-Burlington) of 1304 Properties are only down 0.2% from June 2019 and up 53.0% from last month, May 2020! The overall average price for residential properties increased by 13.7% from June 2019 to $675,223 and is also up 3.0% from last month. Hamilton’s Residential Sales (including Flamborough, Dundas, Ancaster, Waterdown, Stoney Creek and Glanbrook) were 825, only down 4% from 860, with an average price of $619,049 up 14% from June 2019. Burlington had 319 Sales which is up 7% from 299, with an average price of $872,398 which is up 12% from June 2019.

The end of month listing inventory which is a good indication of the type of market currently being experienced shows 1024 Active Residential Listings giving Hamilton 1.2 months of inventory, down 26% from June 2019. Burlington has 363 Active Residential Listings giving it 1.1 months of inventory, down 25%. The average days on the market dropped from 25.6 in 2019 to 21.6 in 2020 in Hamilton and also went down in Burlington from 25.5 to 18.8. Right now the Hamilton-Burlington Area is still sitting in a Sellers Market, where the ratio of Homes Sold to Homes Listed is above 60%, currently sitting at 72.2%. In other words, 7.2 homes are sold for every 10 new listings. Note that this has increased to almost the same amount as it was in February 2020 (before Covid-19) which was in a strong Sellers Market at 73.7%! It will be interesting to see how the rest of the year will be with the implementation of the new guidelines coming into effect from CMHC (Canada Mortgage and Housing Corporation). People that need to use CMHC will have to have a Credit Score of 680 or above and the TDS and GDS ratios will now be lower. Two other companies have decided not to follow the same guidelines for now, as CMHC, so there could be some other options if you do not qualify with CMHC. Check again with your Mortgage Broker to see what this will mean for your qualification! Homes Sold to Homes Listed Ratio: Buyers Market is below 40%, Balanced Market is between 40-60%, and Sellers Market is above 60%.